The rules for the state and local tax (SALT) deduction are changing again under the One Big Beautiful Bill Act (OBBBA). The expanded caps, beginning in 2025, create real opportunities for homeowners, high-income earners, real estate investors, and pass-through business owners. These benefits increase slightly each year through 2029, then drop back to the original $10,000 cap in 2030.

Understand how the rules work in 2025 and 2026, what stays the same through 2029, and what ends in 2030. This will help you decide when to itemize, how to manage income, and how to use the pass-through entity taxes (PTET) workaround to reduce federal taxes.

But First, What Counts as SALT?

The SALT deduction covers the following state and local taxes:

- Income taxes

- Real estate property taxes

- Personal property taxes

- General sales taxes if you choose to deduct sales tax instead of income tax

Foreign real property taxes are not deductible for individuals. Additionally, taxes that relate to a trade or business, including rental property taxes, are not counted toward the SALT cap and remain fully deductible.

Important SALT Deduction Rules for 2025 to 2029

Here are the key rules for SALT deduction you should know:

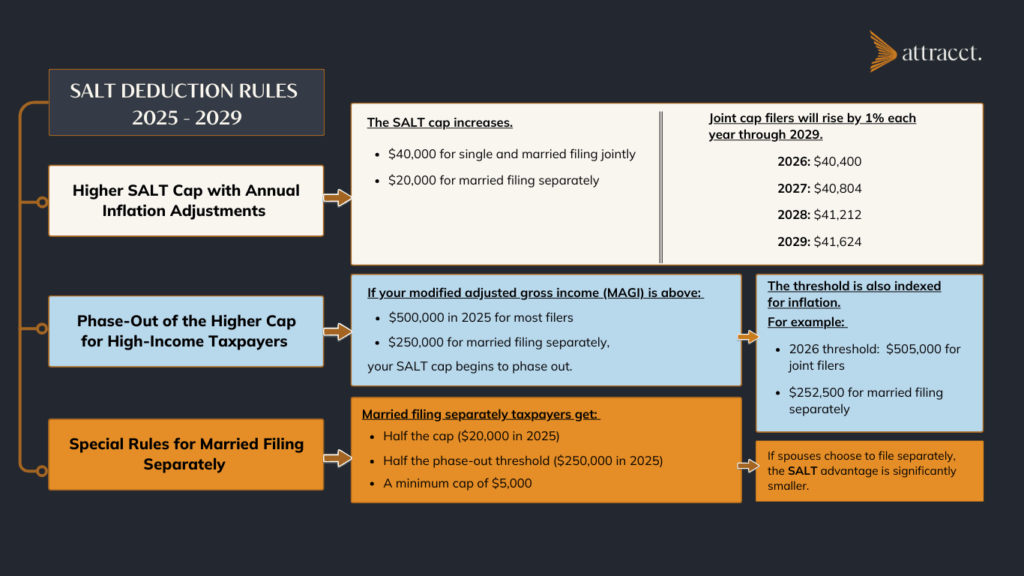

Higher SALT Cap with Annual Inflation Adjustments

Starting in 2025, the SALT cap increases to:

- $40,000 for single and married filing jointly

- $20,000 for married filing separately

Beginning in 2026, the cap increases by 1 percent every year through 2029. Here’s how it will work for joint filers:

- 2026: $40,400

- 2027: $40,804

- 2028: $41,212

- 2029: $41,624

Phase-Out of the Higher Cap for High-Income Taxpayers

The expanded SALT cap does not apply to everyone. If your modified adjusted gross income (MAGI) is above:

- $500,000 in 2025 for most filers

- $250,000 for married filing separately,

your SALT cap begins to phase out.

The threshold is also indexed for inflation. For example:

- 2026 threshold: $505,000 for joint filers

- $252,500 for married filing separately

How the phase-out works

The phase-out lowers your SALT deduction if your income is above a certain limit. [update this for 2026 please, since it’s too late to plan for 202] In 2026, if your income exceeds the threshold, your maximum deduction is reduced by 30 percent of the extra amount, but it will never go below 10,000 for joint filers or 5,000 for married filing separately.

For example, a couple filing jointly with $550,000 in income is $50,000 over the $500,000 threshold. Thirty percent of that extra $50,000 is $15,000, so their SALT deduction cap drops from $40,000 to $25,000. A lower deduction threshold imputes a higher taxable income. However, the deduction cannot fall below $10,000.

Minimum cap protection

According to the Internal Revenue Service (IRS), your cap cannot be reduced below:

- $10,000 for most filers

- $5,000 for married filing separately

This is important for high earners whose income would otherwise wipe out the entire expanded deduction.

Special Rules for Married Filing Separately

Married filing separately taxpayers get:

- Half the cap ($20,000 in 2025)

- Half the phase-out threshold ($250,000 in 2025)

- A minimum cap of $5,000

If spouses choose to file separately, the SALT advantage is significantly smaller.

PTET Workaround Remains Fully Intact

Earlier drafts of the OBBBA suggested limiting passthrough entity tax (PTETs) elections. The final bill did not change PTET rules.

Key points:

- PTETs paid at the entity level remain fully deductible for federal purposes.

- They reduce federal taxable income because the tax is paid by the entity, not the owner.

- Owners receive a state tax credit on their personal return for their share of the PTET.

- IRS Notice 2020-75 remains the controlling authority.

- No new IRS guidance has changed this treatment as of July 2025.

This remains one of the biggest planning tools for business owners and real estate investors.

Important Nuances That Affect Whether You Benefit

The Standard Deduction Is Increasing

The standard deduction rises again in 2025 and 2026. Fewer taxpayers will itemize, which means not everyone gets value from the higher SALT cap as it only benefits those who itemize.

Let’s take an example: If your standard deduction is $33,100 in 2026 for joint filers, you need itemized deductions above that amount to benefit from the SALT increase.

State Conformity Is Not Guaranteed

Some states automatically follow federal tax updates. Others do not.

States may choose to decouple from the federal SALT changes, especially if adopting the new rules would reduce state revenue. Taxpayers should check their state’s legislation each year.

If you want to discuss your case, our tax experts can help you. Contact us.

“Bunching” Deductions Has Limits

Many taxpayers try to bunch two years of SALT payments into one year to maximize itemized deductions. This strategy works only if:

- The payments are for actual liabilities

- Prepayments are allowed

- You do not trigger taxable refunds in the next year

Prepaying more than your true liability often results in a refund that becomes taxable under the tax benefit rule.

New High-Income Itemized Deduction Limitation

For high earners in the 37 percent bracket, itemized deductions face an additional reduction. Itemized deductions are reduced by:

2/37 of the lesser of:

- Total itemized deductions

or

- The amount of income above the 37 percent bracket threshold

This reduces the real value of the SALT deduction for ultra-high-income taxpayers.

Planning Opportunities Before the Window Closes

Here are some tips for you to get the most out of SALT deduction.

Run a Two to Five-Year Projection

You’ll want to forecastwhen itemizing becomes valuable, when phase-outs apply, and how the expanded caps affect your tax outcome.

Manage Income Around the Threshold

Deferring income or accelerating deductions can help keep your MAGI below the phase-out level.

Consider PTET Elections

If your business operates in a state with a PTET option, this remains a strong workaround to reduce personal exposure to the SALT cap.

Review Property Tax Payment Timing

Property taxes must reflect your actual liability for the year. If prepayment is allowed, paying them in a year where you itemize can increase the tax benefit.

Separate Business and Personal Taxes Clearly

Generally, on most pass-through entity financial statements, federal or state income taxes are not shown as expenses. However, it’s critical to track PTET payment amounts to ensure this activity is properly reflected on tax returns.

Monitor Your State’s Legislation

States may accept or reject federal SALT rules, which can affect your total liability.

What Happens in 2030

Beginning in 2030, the SALT deduction returns to:

- $10,000 cap

- $5,000 for MFS

- No inflation indexing

- No phase-out rules

This makes 2025 to 2029 a temporary planning period.

Final Thoughts

The new SALT rules under the OBBBA create valuable planning space, but the benefits depend on your income, itemized deductions, state rules, and whether you can use PTET elections. The window from 2025 to 2029 offers meaningful opportunities before the cap resets in 2030.

If you want help modeling scenarios or building a multi-year tax plan, Attracct Advisors can walk you through the numbers and help you capture every available deduction. Book a Meeting with our experts.