Selling a property is a major financial event, and understanding capital gains taxes on real estate is crucial to retaining a larger portion of your profit. Many property owners are surprised by the tax bill, but the right planning tactics can save you thousands. This guide breaks down the latest rules and proven strategies, like the $250,000/$500,000 home sale exclusion and 1031 exchanges, so you can make smart decisions.

What Are Capital Gains Taxes on Real Estate?

When you sell real estate for more than your adjusted basis, the IRS taxes the profit, not the full sale price.

Your adjusted basis is generally what you paid for the property plus the cost of qualifying capital improvements (for example, a new roof, an addition, or major system upgrades).

Capital gains tax is triggered only on the gain after subtracting this adjusted basis from your net sales price (after commissions, closing costs, etc.).

Long-Term vs. Short-Term Gains: Key Difference

- Short-Term Gain: If you owned the property for one year or less, the gain is taxed at your ordinary income tax rates. These can go as high as 37% under the 2025 brackets.

- Long-Term Gain: If you held the property for more than one year, it qualifies for preferential long-term capital gains tax rates, which are lower (0%, 15%, or 20%) depending on your taxable income.

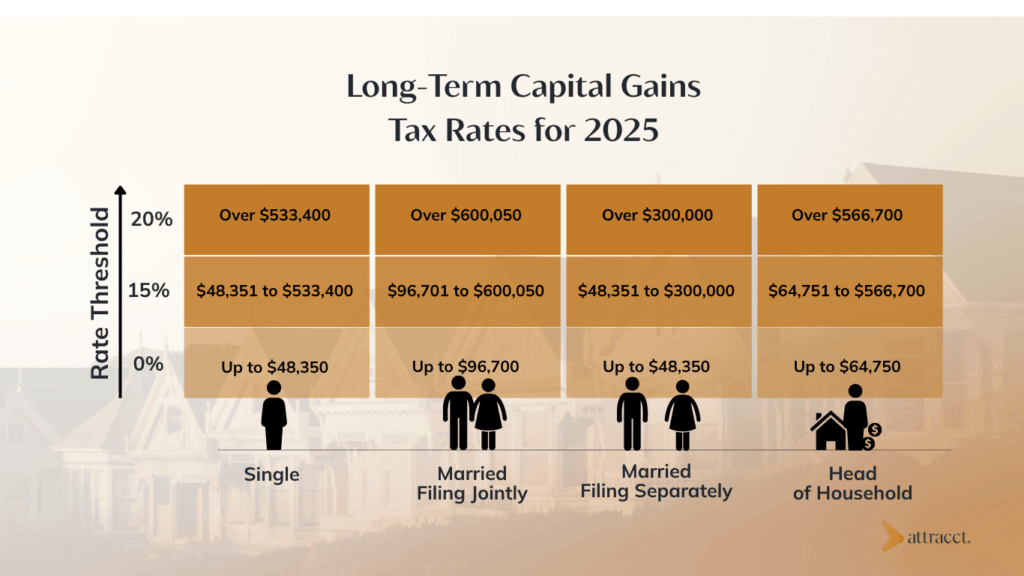

Long-Term Capital Gains Tax Rates for 2025

Here are the 2025 federal long-term capital gains rates and income thresholds:

| Filing Status | 0% Rate Threshold | 15% Rate Threshold | 20% Rate Threshold |

| Single | Up to $48,350 | $48,351 to $533,400 | Over $533,400 |

| Married Filing Jointly | Up to $96,700 | $96,701 to $600,050 | Over $600,050 |

| Married Filing Separately | Up to $48,350 | $48,351 to $300,000 | Over $300,000 |

| Head of Household | Up to $64,750 | $64,751 to $566,700 | Over $566,700 |

Keep in mind: If your income (MAGI) exceeds $200,000 (single) or $250,000 (married), an additional 3.8% Net Investment Income Tax (NIIT) may apply to your capital gains and other investment income.

The $250,000 / $500,000 Home Sale Exclusion

This exclusion (IRC § 121) is a powerful tool for homeowners. If you meet both the ownership and residency tests (you must own and live in the home for at least two out of the last five years), you can exclude:

- Up to $250,000 of gain if filing single

- Up to $500,000 of gain if married filing jointly

For an example, David and Sarah bought their home for $300,000, lived there 7 years, and later sold it for $850,000. Their gain is $550,000. Because they qualify, they exclude $500,000, and only $50,000 is subject to capital gains tax.

If you do not fully meet the two-year test due to job relocation, health reasons, or unexpected events, you may qualify for a partial exclusion under IRS rules.

Key Strategies to Avoid Capital Gains Tax

Use the Primary Residence Exclusion

If you currently own a property used as a rental or an investment, consider converting it to your primary residence for at least two years before selling. But this strategy has strict rules; timing and intent are critically important. (Note: Specific rules apply to periods of non-qualified use; talk to a CPA to get a personalized strategy for your case).

Execute a 1031 “Like-Kind” Exchange

For purely investment or business real estate, a 1031 exchange lets you defer capital gains taxes by reinvesting proceeds into another qualifying property. The rules are strict: According to the IRS, you must identify a replacement within 45 days and close within 180 days, and you must use a qualified intermediary.

Harvest Investment Losses

If you hold other investments (stocks, bonds, etc.) that are underwater, you can sell those at a loss and use those losses to offset your real estate gain. This is often underutilized.

Time Your Sale in a Lower-Income Year

If possible, delay the sale to a year when your taxable income is lower. With a lower income, you might qualify for the 0% rate or less steep brackets.

Gift or Transfer to Family (with caution)

In very specific circumstances and with good tax planning, transferring property to a family member in a lower bracket before a sale can reduce total tax. But this is complex and should be handled with expert advice.

The Depreciation Recapture Trap for Rental Properties

If you owned a property used for rental or business, you likely deducted depreciation year by year. When you sell:

- The IRS “recaptures” the depreciation you claimed, taxing that portion of gain at up to 25% (often called unrecaptured § 1250 gain) even if your overall gain falls in a lower capital gains bracket.

- After recapture, any remaining gain is taxed at the long-term capital gains rate (0%, 15%, or 20%) depending on your taxable income.

Example of Depreciation Recapture Trap

You bought a rental for $500,000 and claimed $150,000 in depreciation over time. When selling, the first $150,000 of gain (to recapture depreciation) is taxed at up to 25%, and any excess gain beyond that is taxed under the capital gains rates.

Because depreciation recapture can take a big chunk out of your profit, combining a 1031 exchange (to defer both gain and recapture) is a common strategy among savvy real estate investors.

Don’t Forget State Capital Gains Taxes

The rates discussed above are federal. Each state may impose its own capital gains or income tax, which can raise your overall tax liability. For example:

- States like Texas, Florida, and Nevada have no state income tax (so no state capital gains tax).

- States like California treat capital gains as ordinary income, with a top rate over 13%.

Always factor in your state’s rules when planning.

Minimizing capital gains tax comes down to proactive tax planning. Applying the tax strategies correctly requires expert input from a tax specialist. Contact a tax expert to build a tax strategy unique to your financial situation so that you retain more of your profit.

Frequently Asked Questions (FAQ)

Do I have to buy a more expensive property for a 1031 exchange?

Yes. To defer all capital gains, your replacement property must be of equal or greater value, and you must take on debt (if any) of at least the same amount.

Is the loss on the sale of my primary home deductible?

No. Losses on the sale of your primary residence are not deductible under current tax law.

How does selling an inherited property work?

You typically receive a “stepped-up basis,” meaning your cost basis for tax purposes is the fair market value at the time the original owner passed. That often minimizes or eliminates capital gains if you sell soon after inheritance.

What counts as a capital improvement to increase my basis?

Qualifying improvements are those that add value or prolong the life of the property. Examples include a new HVAC system, addition, full kitchen remodel, or a new roof. Simple repairs (painting, fixing a leak) do not count.

Can I avoid capital gains tax by reinvesting in another home?

No, not for your primary residence sale. The home sale exclusion (§ 121) is different from 1031 exchanges; you cannot defer tax on your primary residence by buying another home. The 1031 exchange is only for investment or business property.

What if I sell a property in a year with unusually low income?

If your taxable income is low enough, your gains might fall into the 0% long-term capital