The Big Beautiful Bill effective date is a crucial detail for anyone impacted by this major federal legislation. Signed into law on July 4, 2025, the Big Beautiful Bill introduces sweeping tax and policy changes that affect individuals, families, and business owners across the country. Understanding when these changes take effect helps taxpayers and investors plan ahead and maximize their benefits.

But the main questions remain:

What exactly is changing? And what are the effective dates for these provisions?

This guide breaks down the bill’s key changes by category (income, family, business, and important timelines) so you can see what’s already in effect, what’s coming soon, and what will expire.

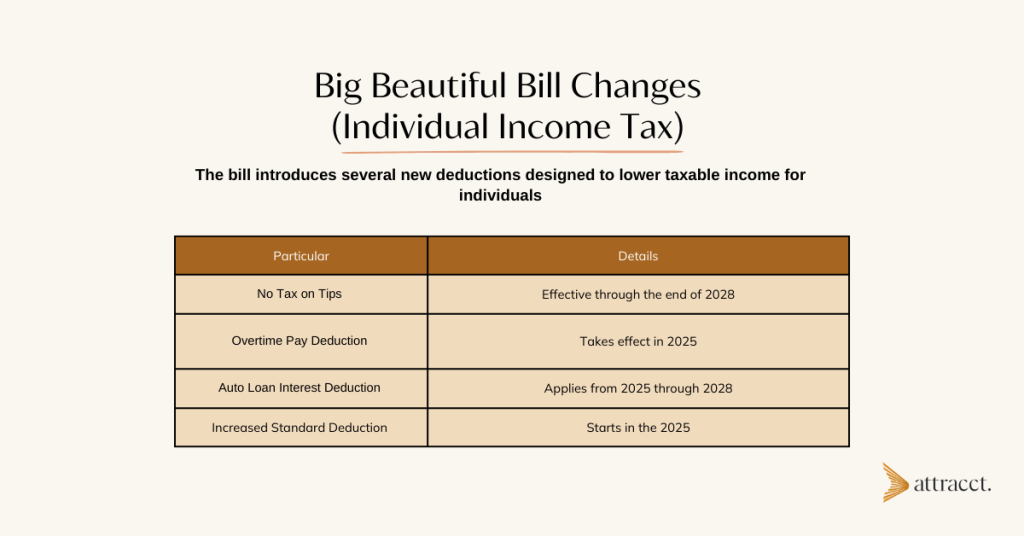

Changes That Affect Individual Income Tax

The bill introduces several new deductions designed to lower taxable income for individuals, especially those in tipped or hourly work, and individuals with auto loans.

No Tax on Tips

Starting in 2025, individuals working in tipped industries can deduct up to $25,000 of their tip income annually, provided they meet income requirements – in other words, high-income earners are phased out starting with earnings over $150,000. This provision is in effect through the end of 2028.

Overtime Pay Deduction

If you earn overtime wages, you may now deduct up to $12,500 per year. This change also takes effect in 2025 and is temporary, ending after the 2028 tax year.

Auto Loan Interest Deduction

A new deduction allows individuals to write off up to $10,000 in interest on auto loans, but only if the vehicle was assembled in the United States. This benefit applies from 2025 through 2028.

Increased Standard Deduction

As part of the Big Beautiful Bill effective date rollout, the standard deduction receives a permanent increase starting in the 2025 tax year to $15,000 for single/married filing separately and $30,000 for those married filing jointly. This change helps reduce taxable income for a broad range of earners.

Support for Families, Seniors, and Dependents

Several updates in the bill directly benefit parents, adoptive families, retirees, and households with dependents.

Expanded Child Tax Credit

The Child Tax Credit increases from $2,000 to $2,200 per child starting in 2025. While not a dramatic jump, it provides additional relief for working families.

Refundable Portion of Adoption Tax Credit

As of 2025, up to $5,000 of the adoption tax credit is now refundable. This change allows more families to benefit, even if they owe little or no tax.

Trump Accounts for Newborns

Children born between January 1, 2025, and December 31, 2028, will receive a one-time $1,000 deposit into a new government-backed savings account. These “Trump Accounts” are designed to support long-term financial security for children. Starting in 2026, families can contribute up to $5,000 per year into these accounts.

Increased Senior Deduction

Seniors aged 65 and older with income under $75,000 (or $150,000 for joint filers) will now receive an additional $6,000 standard deduction per person. This change starts in 2025 and will remain in place through the 2028 tax year.

Tax Breaks for Business Owners and Investors

The bill includes several provisions that impact how businesses expense, deduct, and invest, especially relevant for contractors, real estate professionals, and small business operators.

Full Expensing for Research and Development

Small businesses can fully deduct qualified research and experimentation (R&E) expenses in the year incurred, rather than amortizing over five years. This change is retroactive to January 1, 2022, offering potential opportunities to revisit past filings or adjust current strategy.

Equipment and Factory Expensing

Effective January 19, 2025, businesses can immediately deduct the full cost of qualified equipment and factory structures placed in service. This first-year expensing option for factories will remain available through 2030.

Expanded Business Interest Deduction

As part of the Big Beautiful Bill effective date changes taking effect in 2025, businesses may deduct a larger portion of their interest expenses. This update is especially beneficial to companies financing real estate, equipment, or working capital.

Higher SALT Deduction Cap

The cap on state and local tax (SALT) deductions increases from $10,000 to $40,000 starting in 2025. However, the benefit phases out entirely for taxpayers with incomes above $500,000 and reverts back to $10,000 in 2030.

Simplified Reporting for B2B Payments

New rules make it easier for businesses to report electronic payments between vendors. These simplified thresholds begin in 2025, reducing red tape for small and midsize firms.

Increased QSBS Capital Gains Exclusion

Investors in qualified small business stock (QSBS) may exclude an additional $5 million in capital gains starting in 2026. This change supports long-term investment in high-growth private companies.

Expansion of Housing and Community Credits

Beginning in 2026, the bill expands the Low-Income Housing Tax Credit (LIHTC) and permanently reauthorizes the New Markets Tax Credit. These changes aim to encourage development in underserved communities.

What’s Temporary and How Can I Plan Accordingly?

While many of the bill’s provisions are already in effect, several have expiration dates or built-in rollbacks that impact long-term tax planning. Understanding each Big Beautiful Bill effective date is critical to making the most of the available tax breaks before they phase out.

Tip deductions, overtime deductions, auto loan interest deductions, extra senior standard deductions, and the $1,000 Trump Account deposits all expire after December 31, 2028.

The increased SALT deduction cap ends after December 31, 2029, returning to a $10,000 limit in 2030.

Full expensing for factory structures remains available through 2030 but reverts to standard depreciation rules starting in 2031.

These dates matter. Depending on your industry and income profile, there may be strong tax reasons to accelerate certain purchases, income recognition, or investments ahead of expiration timelines.

What This Means for You

The Big Beautiful Bill is a mix of immediate relief and temporary incentives. For contractors, business owners, and real estate investors, the coming years present opportunities; most of which, however, are temporary.

You don’t need to understand every line of legislation. But you should know which changes apply to you, when they begin, and when they phase out. That’s where proactive planning comes in.

At Attracct, we’re already helping clients get ahead of these changes, apply the right deductions, and map out how these updates affect short- and long-term tax strategy.

Final Thoughts

The Big Beautiful Bill effective date varies depending on which provision you’re looking at. Some changes are already active. Others are coming in 2026. Many have built-in expiration dates before the decade is out.

The sooner you act, the more control you’ll have over your tax position.

Need help understanding how this affects your 2025 return, or how to position your business before key rules expire? Talk to the experts.