What is Taxable Income – What You Must Know in 2025

Understanding what is taxable income and what is not isn’t just a tax-time chore – it’s a year-round key to clean books and confident business decisions. This guide will help you: Let’s break it down into what you need to report, what you don’t, and where most people get tripped up. Inside, You’ll Learn: Want…

Read MoreIRS Child Tax Credit in 2025: A Practical Guide for U.S. Families

The IRS Child Tax Credit in 2025 is a powerful tool to help working families lower their federal tax bill or increase their refund. This guide walks through what’s available in 2025, who qualifies, how to claim the credit, and what common pitfalls to avoid. Whether you’re a parent, guardian, or tax preparer helping a…

Read More1099 Independent Contractor Taxes: A Guide for Contractors and Businesses

Hiring 1099 independent contractors can simplify payroll and “avoid” payroll taxes, but also brings potential tax and compliance issues. Businesses (especially construction and contractor firms) must correctly classify workers, issue the right tax forms, and handle reimbursements properly. Misclassification is costly: if the IRS finds that a contractor was really an employee, your business can…

Read MoreChoosing Bookkeeping Services for Small Business? 9 Things Most Owners Overlook

Choosing a bookkeeping service provider for small business shouldn’t feel like guesswork. Maybe your last bookkeeper stopped responding. Maybe your CPA is charging cleanup fees every tax season. Or maybe you’ve been DIY-ing and finally hit the point where it’s not worth your time or the risk. Or probably, like most people, your books are…

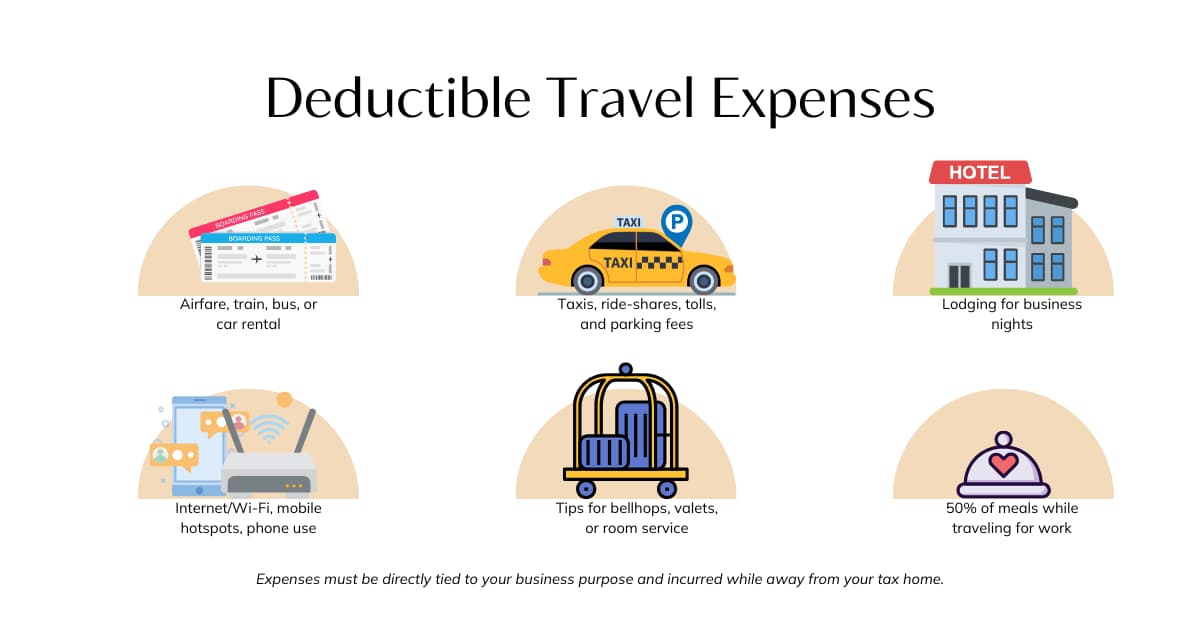

Read MoreAre Travel Expenses Deductible? Your 2025 Guide to Tax-Deductible Business Trips

If you’ve ever asked yourself whether travel expenses are deductible when you’re travelling for business, the answer is yes, but only under the right conditions. Not every trip qualifies, and not every cost is allowed. The IRS has clear rules about when travel counts as a business expense and when it doesn’t. That’s why we…

Read MoreThe Truth About the $3000 IRS Tax Refund: What You Need to Know

Lately, your feed might be flooded with influencers saying the IRS owes you $3,000, no strings attached. The claim is everywhere: “Just file this one form and get $3,000 from the IRS!” Let’s be clear: There is no official IRS program called the “$3000 IRS tax refund.” But the buzz didn’t come out of nowhere. There…

Read MoreLLC vs. S-corp – What’s Right for My Business?

Now that you’ve reached a point where your business is growing, it’s only natural to ask: “LLC vs S-Corp, which is the right fit for my business?” Many business owners hit a tipping point where their current structure no longer supports their growth or tax strategy. But choosing between an LLC and an S-Corp isn’t…

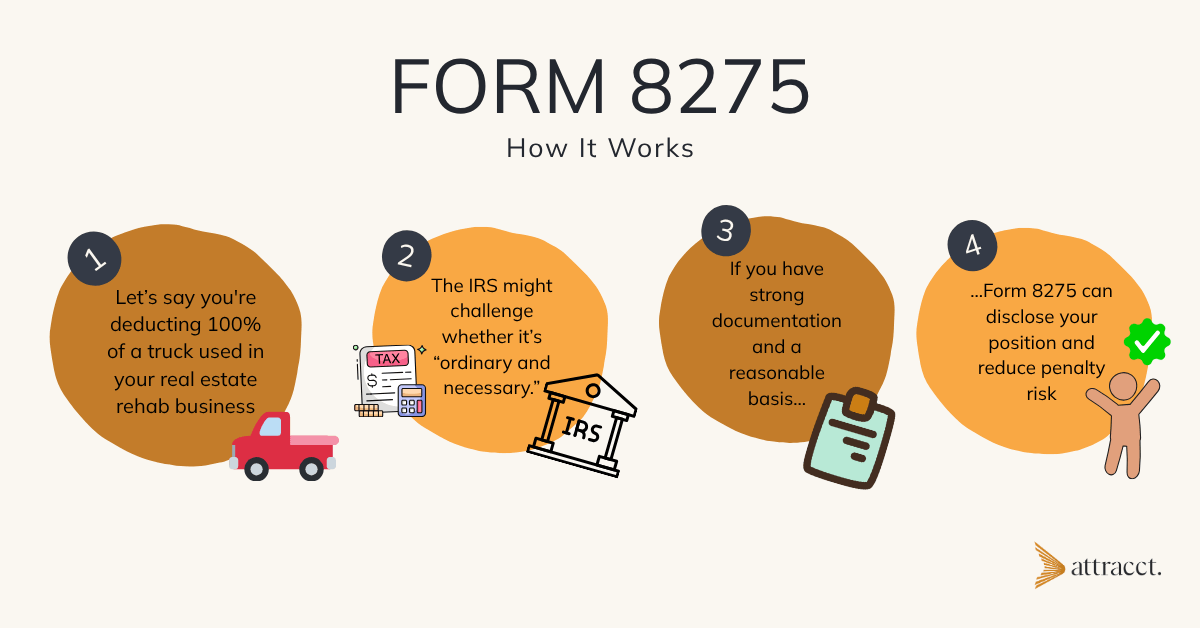

Read MoreWhen Playing It Safe Could Cost You: What to Know About Form 8275

If you’ve ever skipped a legitimate deduction or avoided a gray-area tax strategy just to stay under the IRS radar, you’re not alone. But that’s exactly where Form 8275 can help. This underused disclosure form lets real estate investors, contractors, and business owners take smart, defensible tax positions without risking penalties. It’s not a loophole.…

Read MoreThe Smart Small Business Owner’s Tax Guide

Whether you’re running your first LLC, juggling side gigs, or figuring out how to pay yourself from your business, taxes can feel like one big question mark. That’s why we created The Smart Small Business Owner’s Tax Guide; a practical roadmap built for real people running real businesses. This free guide from Attracct Advisors helps…

Read MoreQ2 Estimated Tax Deadline: What Small Business Owners Need to Know Before June 16

If you run a small business or work independently, staying on top of tax deadlines is crucial. The Q2 estimated tax payment deadline is June 16, 2025. Missing it could result in unexpected penalties and interest, even if you’re expecting a refund when you file your return. Whether you’re a contractor, real estate professional, or…

Read More