If you’re trying to figure out how to minimize taxable income with rental losses, the answer almost always comes down to one thing. You need to understand how the IRS determines whether your activity is passive or non-passive, because that decision controls what you can actually deduct. This is where real estate professional status and the short-term rental material participation rules become your biggest tax levers.

Most investors get stuck because “gurus” online talks about “loopholes” but skips the real mechanics. But here it is: The IRS assumes all rentals are passive, which means losses don’t touch your active income unless you qualify for a specific exception. When you learn how STR rules work, how hours are counted, and how to structure your rental activity, you move from guessing to planning with intention.

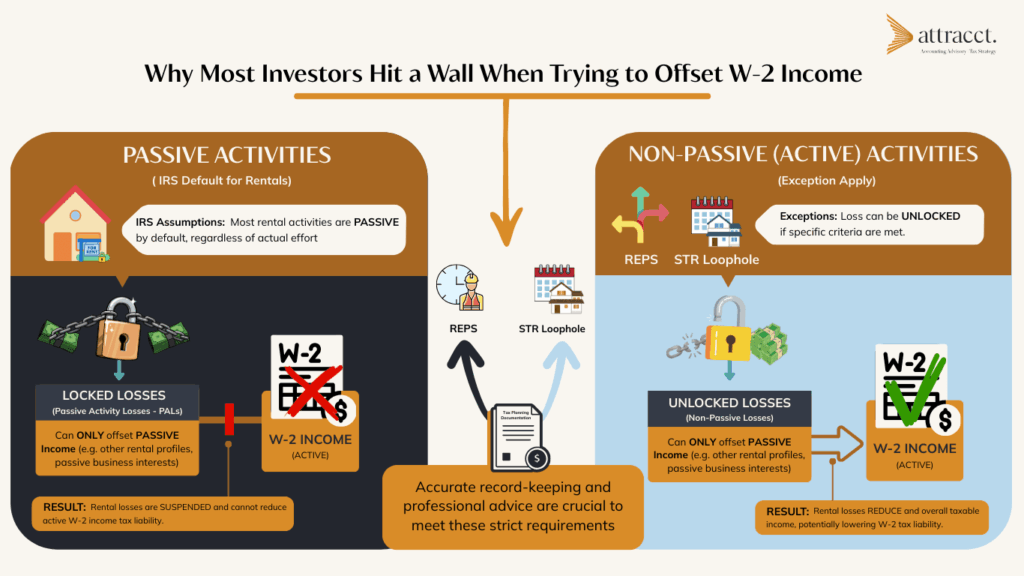

Why Most Investors Hit a Wall When Trying to Offset W2 Income

Start with this simple truth – the IRS is not interested in letting anyone write off rental losses against W2 or business income. They assume rentals are passive income unless you can prove otherwise.

So, if you’re hoping your rental losses will knock down your W2 income, you only have a few paths forward:

-

- a. Your STR activity avoids being classified as a rental activity.

- b. Or you qualify for real estate professional status and materially participate in your rentals.

- You materially participate in the rental activity.

If you miss any of these boxes, your losses get locked up as passive losses. They carry forward to offset future passive income or can be realized upon sale of the property. They do nothing for your W2 income today.

Passive Activity Loss Rules

A passive activity is any business where you don’t materially participate. And according to the Internal Revenue Service (IRS), rentals are automatically passive unless the average length of stay changes.

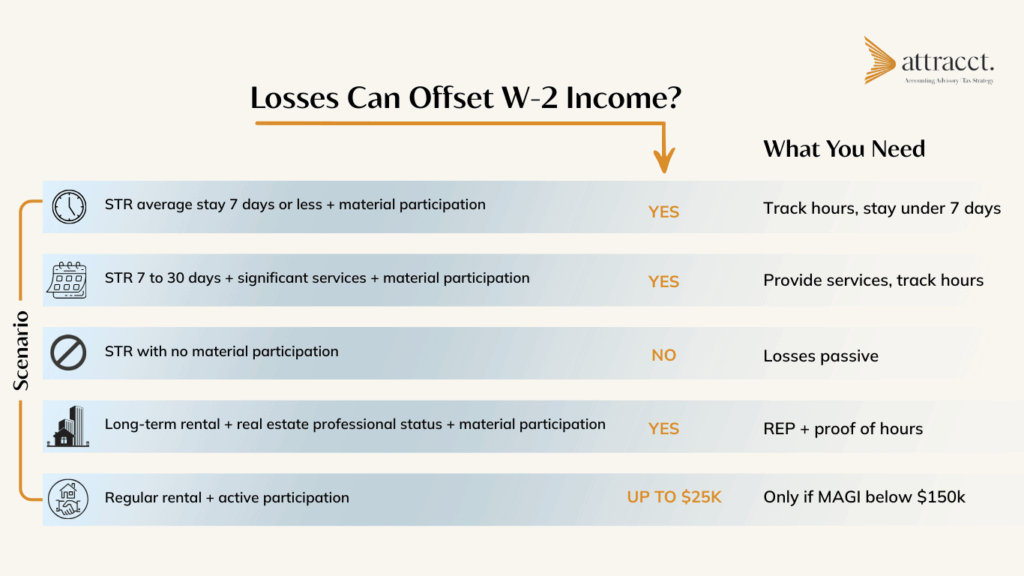

If guests stay 7 days or less, on average, the IRS stops treating it like a rental and treats it like a business.

If guests stay 30 days or less, and you provide significant services, it also is not considered a rental activity.

When it’s not a rental activity, your hours matter. If you materially participate, your activity becomes non-passive, and your losses can offset W-2 income.

Learn what counts as material participation.

How Real Estate Professional Status Changes Everything

Most long-term rental owners cannot use losses to offset W-2 income because their activities stay passive. But real estate professional status flips the rules.

What is a real estate professional status?

You’re a Real Estate Professional if:

- You spend more than 750 hours in real property trades or businesses, and

- More than half your total working time is in real estate, and

- You materially participate in the rental activities you want treated as non-passive.

This is a high bar. It’s made for agents, brokers, builders, developers, property managers, and full-time investors who truly live in the real estate world.

If you qualify and materially participate in your rentals, then rental losses are non-passive, which means they can offset W-2 or business income.

This is your most powerful tax lever.

How Do Short-Term Rentals and Real Estate Professional Status Work Together?

Your STR doesn’t require a real estate professional status to be treated as non-passive.

If it meets the 7-day test or 30-day-with-services test, and you materially participate, your STR losses can offset W2 income even if you don’t have REP status.

That’s often easier than the real estate professional route.

However, if you own long-term rentals, or mixed rentals, or you want more flexibility across multiple properties, a real estate professional status becomes your long-term strategy.

It opens the door to using rental losses across your portfolio to reduce your W2 income.

How Do You Minimize W2 Income Using STR Losses?

Real estate investors commonly ask this question, and we explain it to you in the simplest way.

1. Make sure your STR isn’t classified as a rental activity

Keep your average guest stay under 7 days, or add significant services if you’re between 7 and 30 days.

2. Materially participate

Your hours matter more than anything. You must be the one doing the work.

3. Don’t use the property personally for more than 14 days

Too much personal use triggers Section 280A rules and wipes out your losses.

4. Confirm your at-risk investment

You can only deduct losses up to your at-risk basis.

5. If you want broader benefits, pursue a real estate professional status

This is especially smart if:

- You’re already in real estate

- You own multiple rentals

- You want long-term tax planning

- You want new properties to immediately help offset income

If you think REP status might fit you, we can help evaluate and plan it correctly.

Book a meeting with the experts.

So Which Strategy Should You Use?

If your main goal is reducing W2 or business income taxes quickly, short-term rental material participation is often the fastest, easiest path.

If your long-term goal is building a real estate portfolio with predictable tax benefits year after year, explore real estate professional status.

Both pathways require planning, documentation, and clean bookkeeping. That’s exactly the expertise we offer to our clients so that they don’t have to worry about the nitty-gritty of it all. Contact us today.

Ready to Build a Tax Strategy?

Reducing W-2 income is absolutely possible when you structure your short-term rental activity correctly. But the IRS requires proof.

Whether you want to qualify for real estate professional status or maximize short-term rental losses, we’ll help you design a plan that works for your time, income, and goals.

Book a meeting with Attracct Advisors and get a strategy that’s built just for you.

Real Estate Investors Commonly Ask

Can my spouse qualify for real estate professional status for our joint return?

Yes. If one spouse qualifies, both spouses get the tax benefit.

Does hiring a property manager ruin material participation?

It can. But if you still perform the majority of hours, you can qualify. It comes down to hour tracking.

Can one STR knock out a big chunk of W2 income?

Yes, if:

- It’s NOT treated as a rental activity

- You materially participate

- Your losses aren’t limited by at-risk or excess business loss rules

We see STR owners wipe out $20,000 to more than $100,000 of tax liability without a real estate professional status.

If I already have a busy W-2 job, can I still qualify for real estate professional status?

Rarely. You would need to spend more time in real estate than in your W-2 job.