One of the most common mistakes business owners make is failing to follow consistent financial reporting. The impact goes far beyond messy or inaccurate numbers. Inconsistent reporting leads to faulty decisions, missed opportunities, and in some cases, financial problems that threaten the stability of the entire business.

Does this happen to you?

You pull last month’s financial report and see a healthy profit, so you decide to invest in new equipment or hire someone. The next month, the numbers look completely different. Now you’re second-guessing your choices and scrambling to figure out what happened to your cash flow.

This situation is more common than you think. And in most cases, the issue is not incorrect math. It’s inconsistent financial reporting.

When your data is recorded, categorized, or presented differently from month to month, you lose visibility. Trends disappear. Reports don’t line up. You’re left trying to run your business in the dark. That’s why have consistency in financial reporting is so important.

What Is Consistent Financial Reporting?

Consistent financial reporting means you use the same rules, categories, timing, and formats every time you prepare your financial statements.

Think of it like using the same recipe for your signature dish. When the ingredients are measured the same way each time, you know exactly what caused a good or bad result.

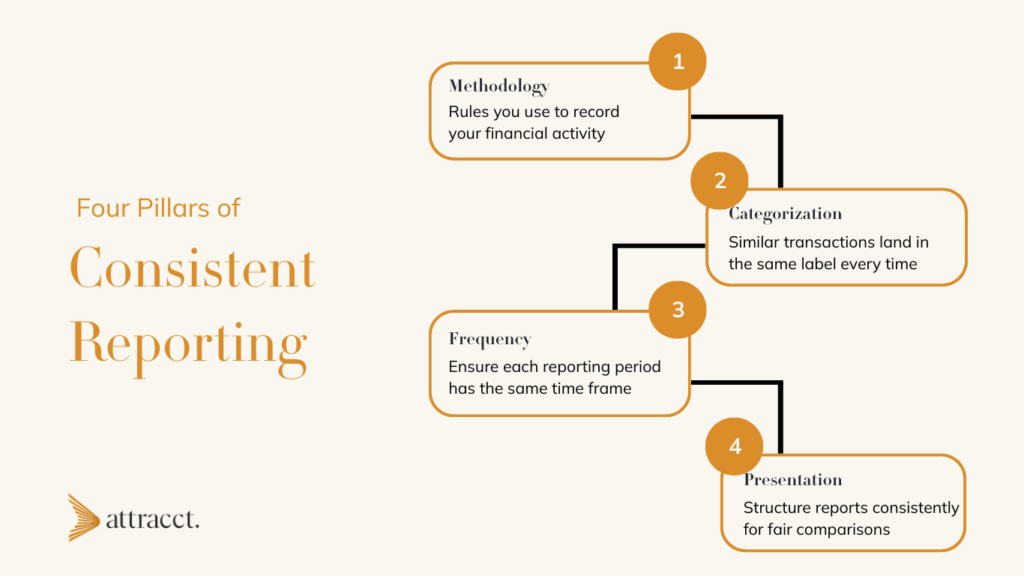

What Are the Four Pillars of Consistent Reporting?

Consistent financial reporting rests on four core pillars. When these are in place, you eliminate guesswork, reduce errors, and build a financial system you can trust.

1. Methodology

This refers to the rules you use to record your financial activity. It includes how you recognize revenue, how you record expenses, and how you handle things like inventory, deposits, or prepaid items.

If these rules change month to month, your reports become impossible to compare.

For example, if you recognize project revenue when cash is received one month, but recognize it when the work is completed the next, your income statement will show a dramatic change, even if the business hasn’t changed.

2. Categorization

This is the backbone of consistent data. Every dollar touching your business needs a label, and that label must stay the same.

If one team member codes a software subscription as “IT,” another uses “Tools,” and a third uses “Software,” your spending will look scattered and unpredictable.

A clean, standardized chart of accounts ensures that similar transactions land in the same place every time. This keeps your reports accurate and helps you understand exactly where your money is going.

3. Frequency

Consistency isn’t just what you report. It’s when you report it. If some months you close your books on the fifth, and others on the seventeenth, you’re not comparing the same time frame. Revenue may spill into the next period. Expenses may be delayed.

A predictable month-end close schedule (for example, “Books closed and reports delivered by the fifth business day”) ensures each reporting period tells a complete and fair story.

This makes your data more actionable because you know every period covers the same time window.

4. Presentation

Even with accurate data, your reports must be structured consistently so you’re comparing apples to apples.

This includes:

- Using the same report formats

- Keeping KPIs and dashboard layouts stable

- Tracking metrics the same way each month

If one month your income statement includes gross margin and the next month it doesn’t, your ability to analyze performance breaks down.

When these four pillars are in place, your financial data becomes reliable and decision-ready.

Why Consistent Financial Reporting Is a Competitive Advantage

Most business owners think financial consistency is something accountants worry about. The truth is that it directly affects your ability to make good decisions.

You spot trends

Are sales slowing, or is it just seasonality? Are costs rising, or is it a categorization error? Consistency lets you see real patterns.

You make confident decisions

Hiring, pricing, product strategy, and expansion all rely on accurate financial information. Consistent reporting removes the guesswork.

You gain credibility with lenders and investors

When your reports are clean, consistent, and clear, people trust your numbers. This improves loan approvals, valuation discussions, and negotiations.

You save significant time and frustration

Your team spends less energy fixing errors or reconciling numbers. You get reports faster and with fewer surprises.

The Hidden Cost of Inconsistent Reporting

Inconsistency usually leads to three problems:

1. Wasted time

When categories change each month, someone has to clean it up. This creates delays and unnecessary labor.

2. Lost opportunities

You miss profitable trends or fail to identify problems early, such as a product line that is quietly losing money.

3. Poor strategic decisions

You may overinvest in areas that are not performing, or pull back in places that are actually growing.

Consistent numbers create clarity. It shows you exactly what’s working and what’s not in your business. From these accurate financial reports, you can correctly identify the underperforming and high-performing projects.

Who Sets the Rules for Consistent Financial Reporting?

Inside your company, you create the internal rules that drive consistency. But those rules should be built on established best practices.

In the United States, financial reporting is guided by GAAP, which is developed by the Financial Accounting Standards Board (FASB). GAAP promotes transparency and comparability across periods.

Business owners do not need to memorize the technical standards. What matters is understanding the principles behind them and building your internal playbook around proven practices.

The Reports Every Business Should Prepare Consistently

To get a full financial picture, you need consistency across four core reports:

1. Income Statement

2. Balance Sheet

3. Cash Flow Statement

4. Statement of Owner’s Equity

Together, these reports give you a complete view of financial health.

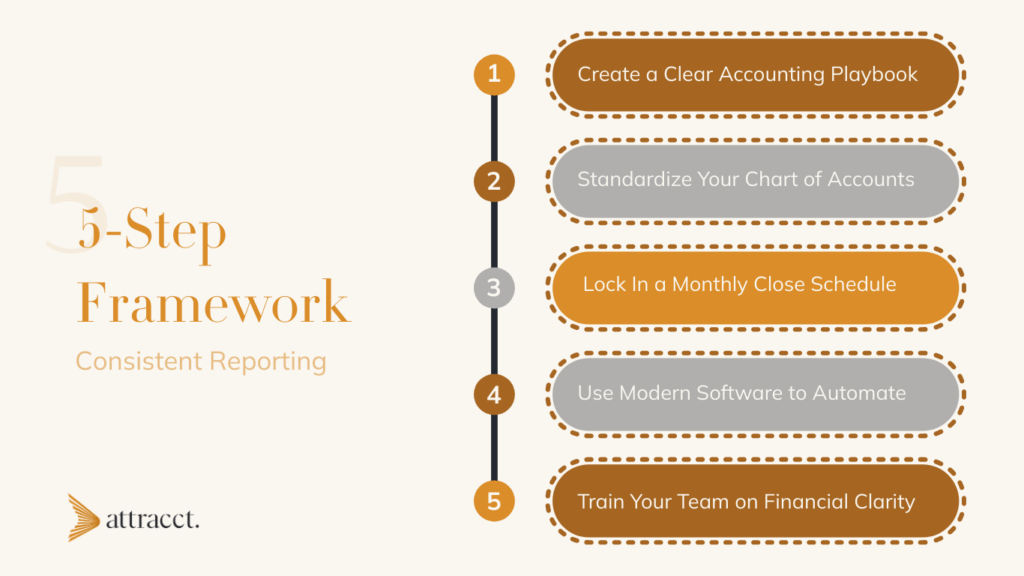

Your 5 Step Framework for Consistent Financial Reporting

Here is a simple, practical framework you can put into place immediately.

Step 1: Create a Clear Accounting Playbook

Document how you recognize revenue, handle expenses, approve purchases, and categorize common transactions. This becomes a single source of truth for your team.

Step 2: Standardize Your Chart of Accounts

Review and clean your categories. Remove duplicates. Rename unclear items. Make sure everyone uses the same accounts in the same situations.

Step 3: Lock In a Monthly Close Schedule

Choose a specific date for finalizing reports. Treat it like a non-negotiable deadline.

Step 4: Use Modern Software to Automate

Systems like QuickBooks Online and Xero can standardize rules, reduce mistakes, and produce consistent reports automatically.

Step 5: Train Your Team on Financial Clarity

Anyone who enters expenses or processes invoices should understand the “why” behind your rules.

Small habits create big consistency.

Best Practices Most Business Owners Never Hear About

Beyond the basics, there are several advanced considerations that matter for reliable reporting. These come directly from authoritative accounting guidance but are explained here in simple terms.

Understand Materiality

Materiality is not just about size. Even small errors can be significant if they affect trends, breach a loan covenant, influence bonuses, or hide fraud. Evaluate errors individually and in total.

Know the Difference Between a Change and an Error

A change in accounting principles must follow specific rules.

A change in estimate is treated differently.

An error is something that needs correction.

Each has its own process for updating prior reports.

Document and Disclose Changes

If you change a policy or correct an error, document what changed, why it changed, and how it affects past numbers. This helps keep your financial history clear.

Avoid Common Pitfalls

The common mistakes that business owners make include:

• inconsistent application of categories

• correcting errors in the wrong period

• netting errors to hide their true effect

• failing to catch qualitative red flags

• delaying needed corrections

Maintain Strong Internal Controls

Clear policies, approval flows, and review steps help prevent mistakes and intentional misstatements.

Rely on Industry Practice Alone

If industry habits conflict with accounting standards, standards take priority.

Business owners do not need to master every rule, but they should be aware of how much these issues matter. Consistency is more than bookkeeping. It is governance.

A Simple Example

Suppose your company spends five thousand dollars on a digital ad campaign.

Inconsistent approach

• Q1: booked as Online Advertising

• Q2: booked as Marketing Campaigns

When you review spending, Q2 looks artificially low. You believe you cut back when you did not. This leads to poor budget decisions.

Consistent approach

• A single category exists called Digital Marketing Ads

• Every ad spend goes to the same place

Now the trend is clear. You can evaluate ROI and plan the right spend level for future campaigns

Build Your Business on Clarity

Consistent financial reporting is not just a compliance exercise. It is a business strategy. When your financial data is reliable and clear, you make better decisions, identify opportunities earlier, and steer your business with confidence.

Your numbers should work for you, not against you. With the right framework and support, they will.

Creating a consistent reporting framework takes time. As a business owner, your focus is growth, not accounting rules.

Attracct can help you by:

• Designing a consistent financial reporting system tailored to your company

• Cleaning up and optimizing your Chart of Accounts

• Producing clear financial reports you can trust

• Helping you interpret trends and make strategic decisions

• Providing ongoing advisory support that grows with your business

We help you move from disorganized numbers to financial clarity so that you make a sound decision for your growth and profitability.