What difference does it make if you sell shares of common stock, crypto, or a small business asset held for 9 months vs. 13 months? Simple answer: that one-year threshold marks the difference between “ordinary income tax” and “preferential capital gains tax.” But what does it mean for your tax bill? That’s the answer you’ll get by the end of this blog, including other answers about what “short-term capital gains tax” really is, how it works, the rates, pitfalls, and smart planning to minimize your tax burden.

What is a Capital Gain?

When you sell assets like stocks, mutual funds, cryptocurrency, real estate, or even a business asset for more than you paid for it, that profit is called capital gain. The IRS treats these gains differently depending on whether you owned the asset for a short time or held onto it longer.

Short vs. Long-Term Capital Gains: What’s the Difference?

Before selling, if you hold your asset for one year or less (365 days or fewer), the profit you earn is a short-term capital gain. Meaning, it’s taxed at your ordinary income tax rate, just like your regular, ordinary income.

If you hold it for more than one year, it becomes a long-term capital gain, which typically qualifies for lower tax rates.

For example, you buy a boat and rent it out for 11 months, then sell it for a profit. The IRS sees that as short-term, and you’re taxed like someone earning an extra salary. But if you hold onto that same boat for 14 months before selling, the gain qualifies as long-term capital gain. That further implies that the gain qualifies for gentler tax treatment.

The distinction between short vs. long-term capital gains matters because it means the difference between paying, say, 37% on your gain versus 20%. The tax code rewards longer holding periods with lower tax to encourage and incentivize investment.

What Are the Short-Term Capital Gains Rates?

Short-term capital gains are taxed at the same rate you pay on your regular income. That means short-term gains get added to your regular income and are taxed depending on your income bracket. Keep in mind, state taxes may also apply (often at the same rate as the state taxes for your ordinary income).

For the 2025 tax year (filing in 2026), federal income tax rates for short-term gains range from 10 % to 37%, depending on your taxable income and filing status.

Short vs Long-Term Capital Gains Tax Explained (2025 Rates)

Suppose you earn a W-2 salary of $90,000 and sell stock for $20,000 profit after holding it less than a year. That brings your total taxable income to $110,000 (ignoring deductions for simplicity). Because short-term gains are treated as ordinary income, part of this income falls in the 24% marginal tax bracket.

Now imagine you had held that same stock for more than a year. The $20,000 gain would be treated as a long-term capital gain, potentially taxed at 0%, 15%, or 20%, depending on your total income.

Even a small difference in holding period can save thousands in taxes. At Attracct Advisors, our CPAs can help you run these “what-if” scenarios so you can make informed decisions about when to sell and how to manage your tax exposure.

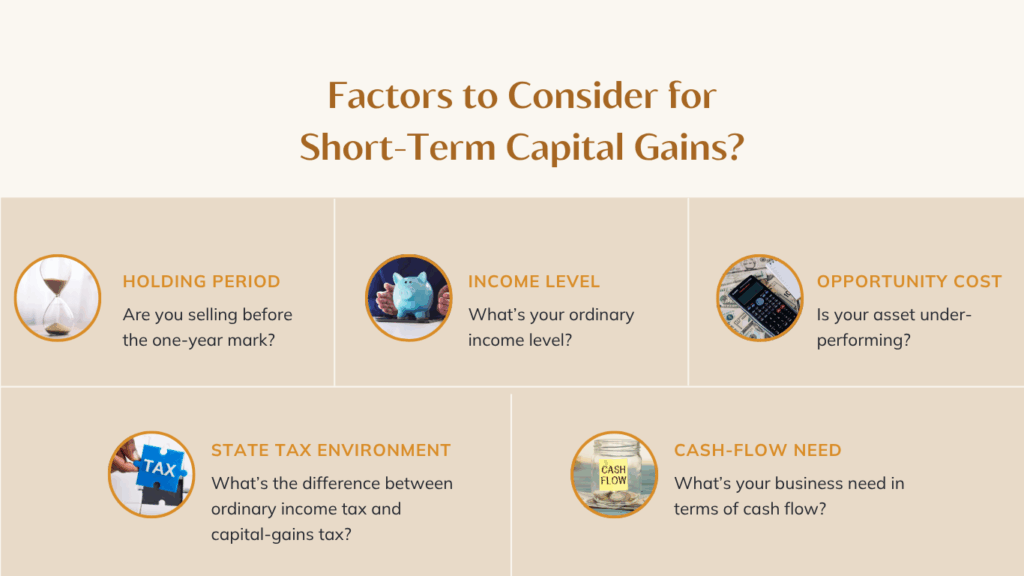

At What Point Is It Worth Taking Short-Term Capital Gains?

This is a key strategic question for investors and business owners alike; not just what the tax is, but when it makes sense to trigger it. Here are the factors you should consider:

- Holding period: If you sell before the one-year mark, you’re paying ordinary income tax (which could be much higher than the long-term rate you’d get if you waited).

- Your income level: If your ordinary income is already high, adding a big short-term gain could push you into an even higher bracket.

- Opportunity cost: If the asset is under-performing or you need liquidity, you might accept the higher tax to capture value.

- State tax environment: In some states, the difference between ordinary income tax and capital-gains tax is larger.

- Cash-flow or business need: Sometimes you need to sell, but you’ll want to run the numbers first.

When Short-term Gains Make Sense

- You expect your income to drop next year (so your ordinary rate will be lower).

- You anticipate the asset will decline in value (so holding longer may reduce your net gain).

- You need liquidity for another higher-return investment.

- You sincerely believe you can’t hold for a full year (due to business or personal reasons) and want to optimize within that constraint.

However, it usually doesn’t make sense to take short-term capital gains when your ordinary income tax rate is high, and you could hold the asset just a little longer to qualify for the lower long-term rate. In these situations, waiting even a short amount of time can result in significant tax savings.

Attracct Advisors’ CPAs can help you run what-if scenarios for your investments to see how timing affects your taxes and plan smarter. Contact us today.

How to Avoid or Reduce Tax on Short-Term Capital Gains

You can’t always avoid tax altogether, but you can plan smartly to reduce the impact. Here are some strategies:

- Hold the asset for more than one year: the simplest route. If you’re at 11 months, consider waiting 2 or 3 more weeks to cross the threshold.

- Tax-loss harvesting: If you’ve got investments that are down in value, you can sell them to generate losses that offset short-term gains.

- Use tax-advantaged accounts: If possible, hold high-turnover assets inside an IRA/401(k) where capital gains tax rules may differ (or be deferred).

- Timing sales for lower-income years: If you know next year your income will drop (e.g., retirement, business slowdown), plan sales then.

- State jurisdiction planning: If you live in (or move to) a state with no or low income tax, the total tax on short-term gains may drop.

- Good documentation/accounting: Cost-basis, holding periods, adjustments matter; keeping clean records ensures you don’t miss deductions or misreport.

Example:

Let’s say you’re a business owner and you foresee a leaner year next year. You have an asset you could sell now (short-term) or wait 9 months and cross into long-term. If you expect next year you’ll earn significantly less W-2 salary, you might plan the sale for next year, reducing your overall tax rate on the gain.

6 Common Mistakes & Pitfalls to Avoid

Here are the most common mistakes and how to avoid them:

- Not keeping track of the holding period.

The clock starts the day after you acquire the asset. Selling just before the one-year mark can turn what could have been a long-term gain into a short-term one, costing you more in taxes. Example: You buy stock on January 1, 2024, and sell it on December 31, 2024—your gain is short-term.

- Ignoring state tax implications.

Some states tax short-term gains at the same rate as ordinary income, which can add up quickly. Example: A $10,000 short-term gain in a state with a 5% income tax adds $500 in extra state tax.

- Not realizing short-term gains increase your taxable income.

This can push you into a higher federal tax bracket, meaning other income may be taxed more heavily. Example: Your salary is $90,000, and a $20,000 short-term gain moves part of your income into the 24% bracket instead of staying in 22%.

- Failing to track cost basis properly.

Commissions, reinvested dividends, and other adjustments affect your gain. Not accounting for these can make you overpay or underreport. Accurate tracking ensures you only pay tax on real gains.

- Confusing frequent trading with investing.

If the IRS considers your activity to be a business rather than investing, your gains may be taxed differently and subject to self-employment rules.

- Not planning for estimated tax payments.

Realizing a large short-term gain mid-year without adjusting estimated taxes can trigger underpayment penalties. Example: Selling $50,000 in short-term gains in June without making an estimated payment could lead to IRS penalties when you file in April.

Want experts to take care of the complexities while you focus on growing your business? Contact us.

Quick Checklist: What to Do When You Realize a Gain

Here’s a practical checklist when you’re about to sell an asset and may trigger a short-term gain:

- Check holding period: Exactly when did you acquire the asset? When will you sell? Are you within the one-year mark?

- Calculate cost basis: What did you pay? What were adjustments (fees, improvements, commissions)?

- Estimate the gain: Sale price minus cost basis equals gain.

- Determine your ordinary income tax bracket: Add this gain to your expected income for the year to see how high the combined taxable income will be.

- Consider waiting: If you’re at 11 months, could you wait a few weeks to cross into long-term? Will your income likely be lower next year?

- Offset strategies: Do you have losses you could realize to offset this gain?

- State tax check: What tax rate applies in your state? Will this sale raise state taxable income?

- Estimated tax/withholding: If you’re going to owe a large tax on the gain, you might need to make an estimated payment so you’re not hit with penalties.

- Document everything: Holding period, purchase date, cost basis, sale date, sale price, and any associated expenses. Keep Brokerage 1099-B, etc.

- Consult your CPA: Especially if you’re dealing with business assets, high-value gains, or complex state tax issues, getting advice from a professional ensures you don’t miss planning opportunities. Consult a CPA to minimize your tax liability.